Indian states.. life in debt…

Our system - of debt-fueled economic growth, of ineffective democracy, of overloading planet Earth - is eating itself alive

- Paul Gilding.

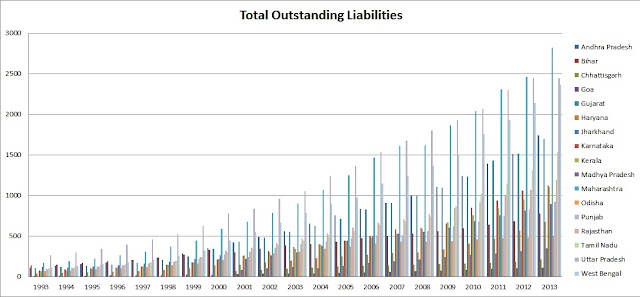

Forget about debt-fueled ECONOMIC GROWTH, few Indian states have only growth in their OUTSTANDING LIABILITIES. We talk too much about outstanding liabilities and Fiscal Deficit of Central government. But we can’t ignore the financial health of Indian states. Andhra Pradesh is continuously borrowing from markets. West Bengal is new competitor for Andhra Pradesh. One might say that revenue deficit or fiscal deficit is under control or government is taking serious steps to control their deficits. But these deficit can't be financed by borrowing. If it is a case then we should start thinking about outstanding liabilities of Indian states.

(Source - Reserve Bank of India - Handbook of Statistics on Indian States. To make it simple, data selection is restricted to 2013 as Telangana state is created in 2014 and Andhra Pradesh is very important state as far as OUTSTANDING LIABILITIES are concerned.)

Every state is showing OUTSTANDING PERFORMANCE in OUTSTANDING LIABILITIES. States are continuously borrowing. Okay, this borrowing can be justified if states have good economic growth. But are these states really growing?

(Source - Reserve Bank of India - Handbook of Statistics on Indian States)

Total outstanding liabilities to GSDP is also increasing. In 2013, debt to GSDP ratio for Andhra Pradesh was around 71% while for West Bengal it was 64%. It's like both states are in competition and they both have forgotten that the in future, these loans have to be paid. If this trend remains same then it will be dangerous for W.B. and A.P.

The borrowing not only restricts the spending of borrower but also increases the interest rate in market. Although it's not applicable here but if O.L. is high enough then to avoid riskiness, state government might have pay high interest on new loans in future. So it might create a debt trap.

Again I am not in favor of restricting the government spending. But it should be productive. We must re-think our policies like subsidies. Agriculture is a state subject. And most of the subsidies are given for this sector. But still this sector is not improving. Government should find an alternative for such policies.

In Maharashtra state assembly, former finance minister informed that although the debt of Maharashtra State is huge, state can borrow more because GSDP of Maharashtra is high compare to the other states. So state government should borrow and spend that money on workers and farmers. Now here is a problem. According to 14th finance commission, for additional borrowing, interest payment to revenue receipts ratio should be less than 10% and debt-GSDP ratio must be less than 25%. According to this criteria Maharashtra is not eligible for additional borrowing as debt-GSDP ratio is more than 25%. Now same former finance minister might demand same thing i.e. state government should borrow or center should provide a financial aid. And center can announce announce any dam package for any state for no reason (except elections). Spending of borrowed money must be restricted to few areas. Gujarat state had debt to GSDP ratio of 25 % in 2016 but in same year, interest to revenue receipts ratio was more than 10%. And now packages are being announced by central government for Gujarat state. These announcements must have some criteria. Even though these announcements are the tools for elections, these announcements are not good as far as financial discipline of state is concern and that's why states are not worried about debt. But when borrower lends money to the next borrower then if one commits suicide, other has to commit suicide because first borrower will lose money and second will lose one lender.

In Maharashtra state assembly, former finance minister informed that although the debt of Maharashtra State is huge, state can borrow more because GSDP of Maharashtra is high compare to the other states. So state government should borrow and spend that money on workers and farmers. Now here is a problem. According to 14th finance commission, for additional borrowing, interest payment to revenue receipts ratio should be less than 10% and debt-GSDP ratio must be less than 25%. According to this criteria Maharashtra is not eligible for additional borrowing as debt-GSDP ratio is more than 25%. Now same former finance minister might demand same thing i.e. state government should borrow or center should provide a financial aid. And center can announce announce any dam package for any state for no reason (except elections). Spending of borrowed money must be restricted to few areas. Gujarat state had debt to GSDP ratio of 25 % in 2016 but in same year, interest to revenue receipts ratio was more than 10%. And now packages are being announced by central government for Gujarat state. These announcements must have some criteria. Even though these announcements are the tools for elections, these announcements are not good as far as financial discipline of state is concern and that's why states are not worried about debt. But when borrower lends money to the next borrower then if one commits suicide, other has to commit suicide because first borrower will lose money and second will lose one lender.

.jpeg)

टिप्पण्या

टिप्पणी पोस्ट करा